Nasdaq is the world’s second-largest electronic market on the stock exchange. It was launched in New York City and operates almost 3500 IT companies. The word Nasdaq stands for National Association of Security Dealers Automated Quotations, the world’s largest tech giant for buying and selling. It was proposed to automate the market after the SEC urged NASD, now known iconic market exchange, to be the first stock exchange introduced in 1971 for businesses.

Here, we will give you essential information about Nasdaq and discuss all the valuable information that guides and gives you a proper understanding, so keep reading.

NASDAQ- History

The National Association of Securities Dealers Automated Quotations NASDAQ was founded in 1971, initially the acronym, and then became NASD, now known as FIRA. This market adopts many changes and grows with time. In 2016, the first woman, Adena Friedmans, transformed the market CEO to lead the U.S. exchange. This exchange enhanced the idea and introduced the board diversity disclosure in December 2020, further enhancing its commitment and claiming the reporting of on-board diversity.

In 2022, Nasdaq reported robust financial performance of the generated revenue with the $1.12 billion income or the $6.23 billion revenue that boosted the revenue growth in fewer expenses to $3.58 billion.

As provoked throughout history, there has been a huge demand in the financial market, in which they regularly adopt innovative changes according to the design of the market and try to provide the most advanced innovations. This first electronic exchange builds innovative indexes to offer the leading technologies worldwide, enabling the 130 markets.

What is the NASDAQ Aim?

With the more advanced adoption of technologies, Nasdaq is trying to work hard to strengthen its economy and provide more opportunities to empower people of every status, group, community, and society and help them reach their full potential. As a technology company, Nasdaq understands its responsibility and works to provide more innovative and incredible discoveries to boost the economic world.

Nasdaq Composition

The Nasdaq 100 consists of 100 large companies that trade on the stock exchange, providing healthcare, resources, customer essentials, and other services across various industries and regions. The Nasdaq 100 index encompasses all sectors and fields, but not in providing services such as finance. In January 2024, the composition returned 2.7% for the year. The top emerging companies in the composition are Microsoft, Amazon, Tesla, Google, and Apple, which are listed on this stock exchange.

Understand the NASDAQ Components

NASDAQ offers a variety of stocks for investors to invest more suitably and informally, which helps mitigate the risk of loss. These stocks are:

Common Stock VS Preferred Stock

It shows the company holding ordinary shares, making it eligible for investors to earn a profit and exercise their rights. While the preferred provides allowances and bonuses before access to the common shareholders without possessing valid rights

| Note: All investors should select the investment method according to their needs and preferences before investing in any stock. |

Income Stock

These stocks continuously provide dividends by increasing the average market value and are suitable for those seeking to invest carefully to attain a stable income. Investors can access amplified high-income ETF YYY exposures in the income stocks of this stock exchange.

| Note: Before investing in income stocks or ETFs, investors should focus on the risks by researching that helps save them from prospects and threats. |

Defensive Stocks

This stock includes Verizon VZ and Cardinal Health, Inc., which provide investors with stability and safety against falls and declines in the market. This stock presents the Invesco Defensive Equity ETF.

| Note: If you are an investor, you should research appropriately to broaden your portfolio and make informed decisions. It’s also essential for your stability in the stock market. |

IPO Stocks

This stock includes the shares’ access from the company while the IPO allocates the discount before the stock exchange lists the company or prevents investors from vesting the schedule, which helps prevent selling shares in commence trade.

| Note: If you are interested in IPOs, you should check out future events and offerings by following the NASDAQ official website. |

Market Capitalization Breakdowns on Nasdaq

Market capitalization is the company’s dollar amount in the market that boosts the stock shares and reflects the market size. This capitalization helps the investors identify and figure out the company and the person generating a good income. The collapse of market capitalization includes large, mid, small, and cap stocks. Let’s move towards discussing distributions:

Large-Cap Stock:

Large-cap is the capitalization of a company in a large market worth above $10 billion. This large-cap index includes companies such as Apple, Microsoft, Amazon, and Tencent, which collectively represent 98.5% of the U.S. market equities. The large-cap stock has a market capitalization of over $10 billion and has substantial liquidity in trading. Investors need to consider market capitalization, as it helps them analyze market trends and mitigate risks.

Mid-Cap Stocks:

Mid-capitalization is normally used to designate companies with a value between $2-$10 Billion. Mid-cap offers advantages for index membership opportunities, funds, and locating assets. The mid-cap companies are used to design the business models and to present the sectors or industries that are expanding their shares and growing fast in the markets. These market stocks play an important role in diversifying the portfolios and accessing the growth.

| Important Note: The mid-cap stick has a greater risk of violating than the large-cap stocks, so be careful while investing. |

The Stock Market’s Latest Performance

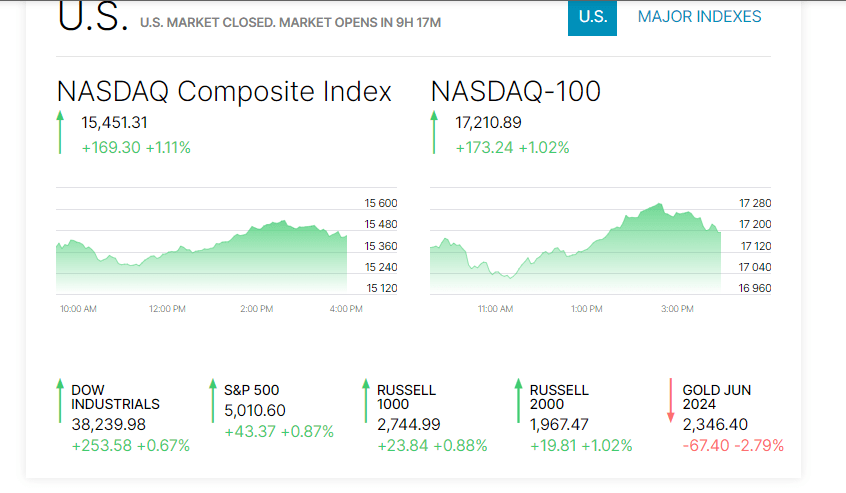

The table shows you its latest performance, including value, change, and change percentage in the stock market, including the Nasdaq composite and 100, Dow industrials, S&P 500, Russell 1000 and 2000, and gold Jun 2024.

| Latest Market Index | Price | Change Value | Change Percentage |

| NASDAQ Composite | 15,451.31 | +169.30 | +1.11% |

| NASDAQ-100 | 17,210.89 | +173.24 | +1.02% |

| Dow Industrials | 38,239.98 | +253.58 | +0.67% |

| S&P 500 | 5,010.60 | +43.37 | +0.87% |

| Russell 1000 | 2,744.99 | +23.84 | +0.88% |

| Russell 2000 | 1,967.47 | +19.81 | +1.02% |

| Gold Jun 2024 | $2,346.40 | -67.40 | -2.79% |

What are Indexes

Indexes have many methods that work for businesses and investors. The top three U.S. stock market indexes include the Nasdaq Composite, S&P 500, and Dow Jones.

S&P 500

The S&P 500 is an index of the 500 largest U.S. companies by market capitalization. These indices show a value of 80%, which is the total value of the U.S. stock market, and provide measures for the U.S. market.

Dow Jones Industrial Average

This index is considered the best blue chip in the U.S. market, with daily dividends and the stock of the 30 largest companies.

Nasdaq Composite Index

The market cap index is weighted to trade on the stock exchange of Nasdaq and has the outside U.S companies. Its index shows the various sectors and subsectors in the technology market stock, including financial, insurance, and transport.

Comparison of Top 3 Indexes

Here is the comparison between the Nasdaq Composite, the S&P 500, and the DJIA.

S&P 500 VS Nasdaq Composite

| It follows the index method | Its value and numbers depend on its index |

| Institutional investors use it | Retailers and investors use it |

| It follows the market cap weighted method | It follows the market cap-weighted method |

| It shows the composition of various sectors and industries | The Nasdaq composite covers the different sectors |

S&P 500 VS DJIA

| The S&P has 500 constituents in stock | While the DJIA has 30 |

| Associated with institutional investors | It is linked with retail investors |

| Uses market capitalisation method | It uses a price-weighted method |

Steps to Invest in Nasdaq

You should consider some essential steps while investing in the Nasdaq stock market U.S. exchange. Follow these steps:

1. Track the latest trends and carefully analyze company performance.

2. Select the method of investing in stocks; these methods include individual stocks and the Index Tracker Funds or ETFs.

3. Open your accounts and ensure security.

4. Fill out the documentation before trading the U.S. shares, like the W-8BEN form.

5. After completing the above two steps, the next step is continuously analyzing your investment.

Conclusion

Nasdaq is the largest trading company in America and holds the 100 largest trading companies in the stock market exchange. It is divided into three market caps: capital, global, or global select markets. This stock exchange holds the companies that depend on various sectors. These sectors are technology, healthcare, insurance, etc, and are called the constituents. Here, we describe all the valuable information related to the largest tech giant in the world, along with its history, components, latest trends, performance, etc. This information will help you understand its significance in the world.

FAQs:

What does the Nasdaq stand for?

It stands for National Association of Securities Dealers Automated Quotations.

Who founded Nasdaq?

In 1971, in New York, the National Association of Security Dealers founded this 2nd world’s largest stock exchange.

Which country owns Nasdaq?

This stock exchange company is based in New York and owned by America.

What are the three types of Nasdaq?

Its types include the global, capital, and select markets.

How does this stock exchange work?

It is a platform that offers electronic exchanges through which dealers or brokers purchase and sell stocks from the market.